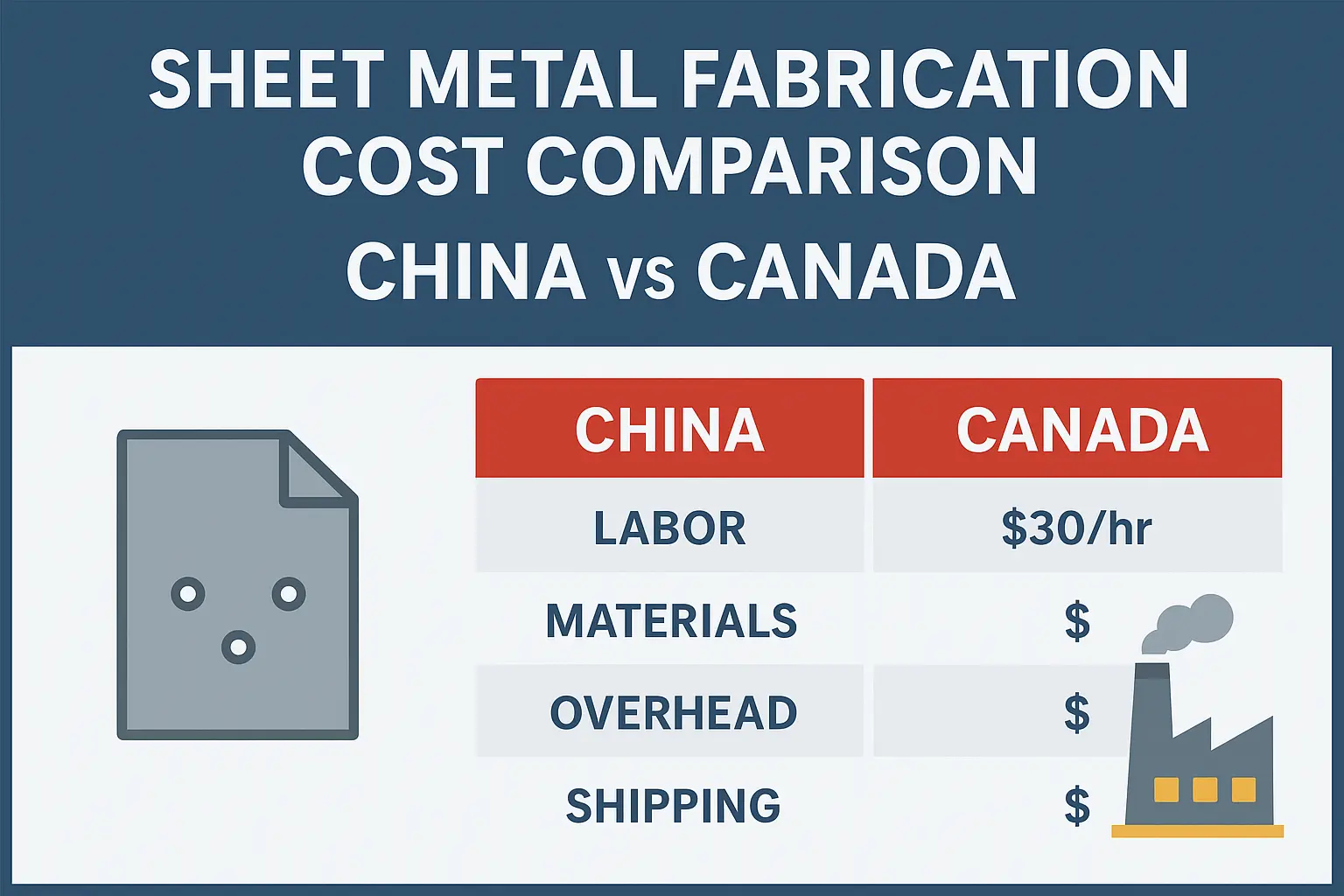

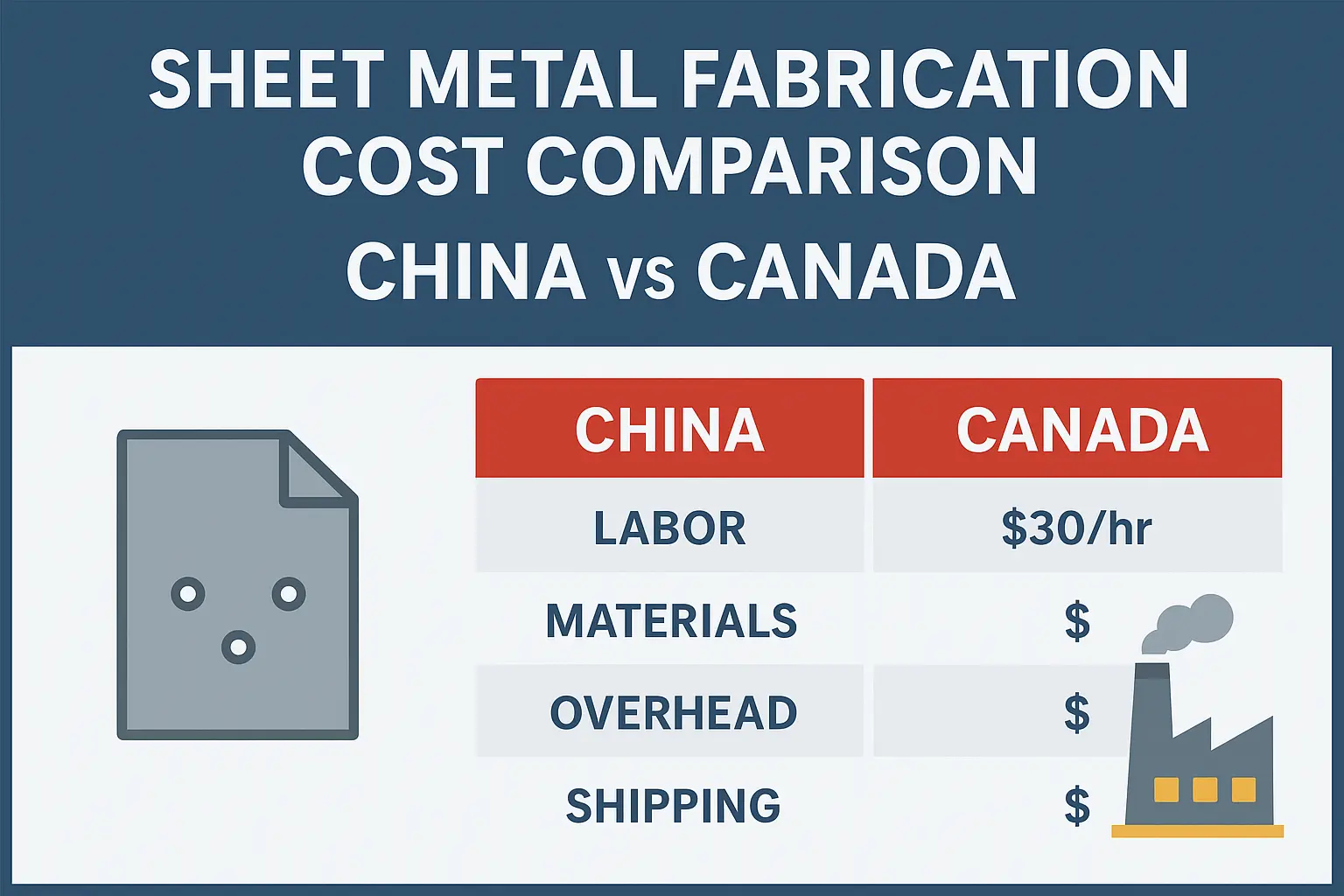

The decision to

manufacture sheet metal parts in China or Canada hinges on a detailed understanding of cost drivers. Key factors include labor rates, raw material and energy prices, equipment and overhead, logistics (shipping and lead time), and tariffs/duties. In Canada, domestic costs are

rising rapidly – real estate, energy, and labor are expensive and increasingly volatile. For example,

Canadian sheet metal fabricators pay skilled workers roughly

C$27–30 per hour (about

$58–62K CAD/year), compared to

~¥52–84 CNY/hour (~US$7–12/hr) in China. This gap (often 3–4×) is a major reason China remains cost-competitive. Many expert analysis notes that “Canada’s manufacturing costs (real estate, energy, labor and materials) are high and rising” and that outsourcing to China can

dramatically lower per-part costs, despite additional logistics.

Key Cost Factors: Canada vs. China

- Labor Costs: The biggest cost difference is labor. Canadian skilled labour for welding, CNC, press brakes, etc., runs about C$27–30/hour, whereas Chinese operators average roughly ¥50–80 CNY/hr (~$7–12 USD/hr). (Even China’s minimum wages are only ~$1.73/hr (PPP) vs Canada’s ~$7.71/hr.) Lower wages in China translate to much lower piece rates on labor-intensive operations. For example, Chinese fiber-laser cuts or press brake bending labor at a small fraction of North American rates, helping them quote ~25% lower landed cost in practice.

- Equipment & Overhead: Many Chinese shops (especially export-oriented ones) invest heavily in modern, automated equipment. HLH Sheet Metal, for instance, uses high-power fiber lasers, multi-axis CNC brakes, robotic welding cells, and advanced metrology. This high automation further reduces labor hours per part. In Canada, smaller shops often run older machines, limiting speed and output. Canadian firms also face higher overhead (insurance, utilities, financing) and expensive industrial rent – often $10–16+ CAD/sqft per year in Toronto/Vancouver – whereas Chinese factories typically rent or own space much more cheaply (industrial land in China averages only ~¥304/m² (~$44/m², or ~$4/ft²). These factors amplify per-unit costs in Canada.

- Materials & Supply Chain: Raw material prices (steel, aluminum, stainless) are global, but Canada’s local supply is limited; many specialized grades must be imported at a premium. A mild steel coil might cost C$1000–1500/tonne domestically, whereas Chinese suppliers often offer slightly lower factory prices and bulk availability. However, Canadian tariffs have become a key factor: as of mid-2025 Canada imposes a 25% surtax on Chinese-origin steel and aluminum. This effectively cancels much of China’s raw material cost advantage unless parts are duty-avoided via non-Chinese inputs or qualification. Our material experts help match North American specs and advise on duties, so clients can predict the true landed material cost.

- Quality and Scrap: High-end Chinese fabricators adhere to global standards (many are ISO‑certified and produce to automotive/medical specs). HLH Sheet Metal, for example, performs 100% QC checks and provides inspection reports, leading to >98% first-pass yield. Still, Canadian shops may charge higher rates to cover training and quality control, whereas Chinese mass-production spreads that cost over large volumes.

- Logistics & Lead Time: Shipping from China adds transit time and freight cost. A 40-foot container from China to Canada typically costs ~$5,000–7,500 USD and takes 30–45 days sea freight (plus customs); air freight is faster (~5–10 days) but ~5× more expensive. By contrast, Canadian manufacturing has minimal delivery lag. Chinese companies assist with bundling shipments (FCL/LCL) and paperwork to keep landed costs predictable.

The table below summarizes these factors qualitatively:

| Cost Factor |

China |

Canada (Local Fabrication) |

| Labor |

~$7–12 USD/hr average (skilled); low labor burden |

~$27–30 CAD/hr (skilled); high labor burden |

| Equipment/Tech |

State-of-the-art (fiber lasers, robotics); high output |

Mixed (some advanced, many older machines); slower output |

| Facility/Overhead |

Lower rent/land costs (e.g. ~$4/ft² industrial land); large-scale plants |

Very high rent ($10–16+/ft²); smaller shops |

| Material Costs |

Competitive bulk material sourcing (often duty-free from many suppliers); 25% Chinese tariffs may apply |

Domestic steel/alum prices may be higher; no import duties on own material (but higher manufacturing cost) |

| Logistics |

+$5K–7.5K per 40ft container; 30–45 days sea or 5–10 days air (faster but expensive) |

Minimal domestic shipping; same-day/next-day options; no overseas transit risk |

| Quality Control |

High (ISO-certified, advanced QC tools); lower scrap with volume |

High (Canadian standards), but smaller runs may increase unit cost |

| Economies of Scale |

Can serve very large batches at constant rates (HLH Sheet Metal scales 500→20,000 units) |

Small-batch runs cost more per part; capacity constraints if rapid scale-up needed |

Real-World Cost Comparisons

Actual per-part prices vary widely by size, thickness, and complexity. However, industry data and supplier quotes illustrate the gap. For a modest 2–3 kg steel bracket, a Canadian shop might quote roughly

C$50–100 per unit for low-volume runs, whereas a Chinese fabricator could land it at

C$35–80 (including shipping) – roughly 20–30% cheaper in some cases. For example, In a

real case of an electronics housing in 5052 aluminum: the Canadian customer saw a

25% reduction in per-unit landed cost by moving production to HLH Sheet Metal. (Domestic suppliers simply “could not meet the target cost” under those specs.) In that case, We turned 500-unit prototypes into a 20,000-unit production run while maintaining tight tolerances and cosmetic finish.

Another Canadian company needed heavy steel frames for outdoor equipment. By outsourcing to China, We enabled them to use the

exact durable material and finish required, without local price concessions, and they launched a product a season sooner. Each client’s savings depend on geometry and volume, but HLH Sheet Metal estimates

landed-cost reductions of 15–30% are common when all factors are counted. (Even after adding freight and the 25% steel/aluminum surtax, the overall cost often remains lower or at parity.)

Beyond Price: Quality, Speed and Scale

Cost is only one side of the comparison. Canadian firms must balance price with quality, lead time, and capacity. Modern Chinese fabricators like HLH Sheet Metal emphasize that they deliver North-American quality at competitive prices. Our advanced

quality management (100% inspection, ISO/TS certifications) yields parts that meet or exceed Canadian standards. We quote >98% parts “on spec or better,” and in certification-heavy industries (automotive, medical) we hold IATF 16949 and ISO 13485 certifications.

Meanwhile, design teams often benefit from Chinese partners’

scale and flexibility. We are capable to do rapid prototyping (parts in days) and then “seamlessly transition” to high-volume runs. This means an engineer can iterate quickly on a prototype and then ramp to thousands of parts without switching shops, saving time and avoiding repeated set-up costs. By contrast, Canadian shops may have longer lead times for both prototypes and scaled production, especially when labor and machine availability are tight.

Comparison Table: Sample Quotes (Hypothetical)

| Example Part: 10×10 cm aluminum bracket (Qty: 100) |

China (landed) |

Canada (domestic) |

| Material (5052 Al) |

$5–6 USD/pc |

$5–6 USD/pc |

| Laser cutting & bending, plus anodize |

$10–12 USD/pc |

$15–18 USD/pc |

| Subtotal (Parts) |

~$15–18 USD/pc |

~$20–24 USD/pc |

| Shipping & Duty (per part) |

~$2–4 USD/pc |

– |

| Total Landed Cost |

$17–22 USD/pc |

$20–24 USD/pc |

| Cost Advantage |

~10–25% lower |

– |

Note: Illustrative only; actual prices depend on design, volume, and timing. We can provide detailed “landed cost” quotes including tariffs and freight.

Strategic Outsourcing Considerations

For Canadian engineers and procurement professionals, the China vs. Canada debate often boils down to

total landed cost and risk. HLH Sheet Metal and others stress transparency: we supply full quotes with DFM feedback and include

tariffs, GST, brokerage estimates so there are “no hidden fees”. In fact, We encourages Canadian clients to calculate

true landed cost up front.

Key considerations beyond raw price:

- Tariffs and Regulations: A 25% surtax on Chinese steel/aluminum is in force, which must be factored into material cost or mitigated (e.g. sourcing compliant inputs). Compliance paperwork and certificates (e.g. mill test certs) are critical to clear customs.

- Currency & Payment: Fluctuating exchange rates can affect quotes. Reliable partners will often invoice in stable currency (USD/CAD) or help hedging. We offers flexible payment terms to ease cash flow.

- Intellectual Property & Control: Engineers may worry about IP. Reputable firms use NDAs, secure facilities, and even invite client visits. Many Canadian companies have successfully collaborated overseas without issues by choosing experienced suppliers.

- Communication & Time Zones: Time difference and language can be challenges. We prides itself on “crystal-clear communication” (fluent English PMs on North American schedules). Project management tools and sample approvals ensure designs are correct before full runs, minimizing errors.

- Quality Trade-offs: The infamous “quality vs. cost” trade-off exists if corners are cut. But modern Chinese specialists can equal or surpass local quality when ISO controls are followed. In fact, by preserving material and process specs (rather than substituting cheaper grades), they often improve product quality at a given cost.

Ultimately, leading Canadian firms view China-based suppliers as strategic

extension of their engineering teams rather than just cheap contractors. As we always says, outsourcing “isn’t about seeking the lowest price… it’s about leveraging a sophisticated and mature manufacturing ecosystem” for scale and innovation.

HLH Sheet Metal’s Value Proposition

HLH Sheet Metal explicitly targets Canadian customers with this value model. Our blogs emphasize

cost savings with no sacrifice in precision. For example:

- Cost Transparency: We assists clients in calculating true landed cost (including shipping, duties, taxes) so quotes reflect the final price. We’ve helped Canadian startups reduce per-part landed costs by ~25% (after all fees) while delivering to North American specs.

- Rapid Turnaround: Our lead times of 5–10 business days by air for prototypes and ~30–45 days by sea for production to Canada. Our multiple plants (~12,000 m² of factories) allow fast scaling from prototypes to tens of thousands of units without new ramp-up delays.

- Advanced Quality: Our Chinese workshops are ISO 9001 and IATF‑certified, with >98% on-spec rate. By contrast, many Canadian shops cut corners on materials or finish to hit a price; outsourcing to us avoids those compromises (they match NA material grades and provide MTRs).

- Scalability: We are capable to handle any volume – from one-off enclosures to mass production – under one roof. We consider Canadian R&D needs, delivering prototypes in days then scaling seamlessly.

- Total Solution: Beyond fabrication, We offers end-to-end service (bending, welding, finishing, assembly) and even assists with import logistics. This simplifies supply chains: engineers can send us CAD files and have finished parts delivered to their dock in Canada, with our support at every step.

In summary, our message is that

“outsourcing sheet metal manufacturing” to China means more than low labor cost – it’s about integrating

world-class technology, capacity and project support into the client’s workflow. Canadian engineers effectively “gain an extension of [their] engineering team” by partnering with HLH Sheet Metal. The bottom line: Canadian clients can offload cost and capacity constraints

while retaining control over design and quality, and focus resources on innovation rather than production headaches.

Conclusion

In the

Canada vs. China sheet metal fabrication comparison,

lower Chinese labor and overhead costs generally give Chinese suppliers an edge on per-part price. However, total landed cost and quality requirements must be carefully evaluated. For many Canadian companies, the savings on labor and equipment – combined with our commitment to quality, transparency, and service – make China an attractive option.

HLH Sheet Metal is a Chinese manufacturer dedicated to meeting Canadian standards. Our cases show real cost savings (e.g. 25%+ landed-cost reductions) without sacrificing specifications. If your project requires precise sheet metal parts at competitive cost – whether a rapid prototype or mass production – we invites you to reach out for a detailed quote.

Ready to learn more? Contact the HLH Sheet Metal team today for a free consultation. Send them your CAD files and requirements to get a

no-obligation quote that includes Canadian pricing, tariffs, and logistics. See how our

precision, scalability, and cost efficiency can bring your designs to life

at the right price.

Contact HLH Sheet Metal: Email

info@hlhsheetmetal.com or submit your inquiry on our website. Build a global supply chain and accelerate your Canadian project today with HLH’s expertise.

Why Canadian Engineers Are Choosing HLH Sheet Metal for Precision Fabrication

How Canadian Manufacturers Can Still Thrive by Sourcing from China

10 Reasons to Choose HLH Sheet Metal as your Metal Fabrication Partner in China

Get A Free Quote On Your Next Sheet Metal Fabrication In Canada.

Send us your CAD files and let us show you how we can bring your design to life with precision and efficiency.