Here’s how the latest U.S.–China tariff developments have played out in China’s metal fabrication sector.

Summary of Key Findings

The May 2025 U.S.–China trade truce cut U.S. tariffs on Chinese imports from 145% down to 30% and Chinese duties on U.S. goods from 125% to 10% for an initial 90-day period, providing short-term relief but not erasing the damage from prior spikes (Time, Reuters). Chinese metal fabricators immediately felt eased cost pressures and a rebound in freight volumes, yet many still struggle with elevated input costs, suspended orders, and an uncertain six-month outlook (Reuters, AP News). Smaller shops—especially in welding, cutting, and precision machining—have been hardest hit by earlier 25% steel and aluminum tariffs, prompting a rush toward automation and “China-plus-one” supply strategies (Manufacturing Dive, Reuters). While the reprieve has sparked cautious optimism, firms warn that long-term resilience hinges on deeper supply-chain diversification and closer collaboration with downstream customers (Reuters, AP News).

Background

Escalation to Peak Tariffs

- Steel & Aluminum Tariffs Reinstated: In February 2025, Section 232 tariffs were fully reinstated at 25% on steel and aluminum, constraining access to key fabrication inputs and triggering Chinese industry warnings about supply-chain disruptions (The White House, Reuters).

- April Tariff Spike: In early April, Executive Orders 14257–14266 raised reciprocal duties on low-value imports and non-tariff measures, with Chinese authorities announcing a 34% tariff on U.S. goods effective April 10, 2025 (The White House, The White House).

Temporary 90-Day Truce

- U.S. Cuts to 30%: As of May 12, 2025, the U.S. suspended 24 percentage points of additional duties—dropping from 145% to an effective 30%—while retaining a 10% base rate for three months (Reuters).

- China’s Reciprocal Move: China simultaneously reduced its retaliatory duties from 125% to 10% on U.S. goods, including machinery and tool imports critical to fabrication shops (Time, China Briefing).

Impact on China’s Metal Fabrication Industry

Rising Production Costs and Operational Strain

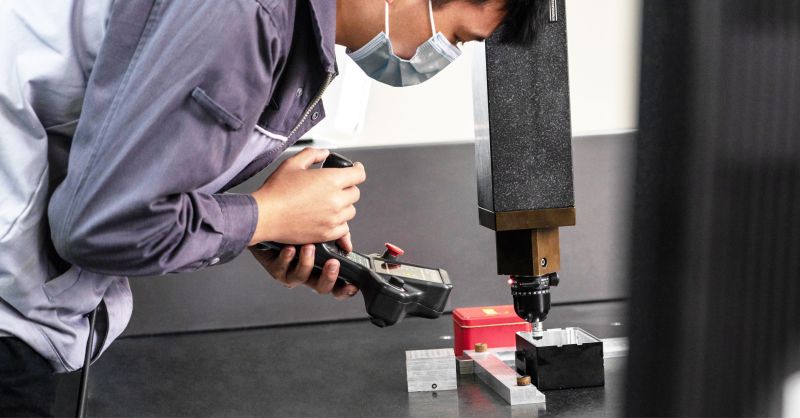

The initial tariff surge slashed profit margins across metal fabrication, welding, and precision machining. Small and mid-sized shops—lacking high degrees of automation—faced 25% extra charges on imported steel and aluminum, pushing material costs up by 15–20% and forcing many to pause new orders (Manufacturing Dive). Larger fabricators managed to absorb some increases but passed costs down the value chain, slowing project approvals and deterring customers.

Disrupted Supply Chains and Project Delays

High duties on metalworking machinery (e.g., CNC routers, press brakes) threatened equipment upgrades, though a few critical machine-tool categories may escape new 25% levies—an unexpected carve-out highlighted by The Fabricator earlier this year (The Fabricator). Meanwhile, rare-earth export controls imposed by Beijing in April squeezed supplies of magnets and alloying elements vital to specialized fabrication (Reuters). As a result, lead times for tool replacement stretched from weeks to months, delaying production lines and contract fulfilment.

Market Uncertainty and Strategic Shifts

Despite the 90-day reprieve, confidence remains fragile. A Reuters-AP survey found that over 60% of Chinese metal goods exporters in Guangdong have suspended expansion plans or begun exploring overseas assembly to hedge against future tariff reversals (AP News, Reuters). Order pipelines are still depleted from cancellations during the high-tariff window—producers of export-oriented components report year-on-year sales down by 20–30% in Q1 2025 (Reuters).

Industry Responses and Adaptation

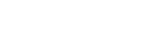

- Automation Investments Firms are accelerating robot-assisted welding and laser cutting projects to reduce labor costs and mitigate exposure to input-price swings (Industrial Equipment News, Manufacturing Dive).

- “China-Plus-One” Supply Models Many workshops are setting up auxiliary facilities in Southeast Asia and Mexico to serve U.S. clients when Chinese tariffs resume (Reuters).

- Customer Partnerships Some fabricators are negotiating fixed-price, longer-term contracts to stabilize cash flow and share tariff-risk with buyers.

Outlook and Recommendations

- Monitor Policy Timelines: The 90-day pause expires on August 10, 2025. Fabricators should develop rapid-response scenarios for both a renewal of low rates and a full reversion to 34%‡.

- Deepen Vertical Integration: Acquiring downstream finishing or assembly capabilities can shield margins from raw-material duty shocks.

- Strengthen Global Networks: Building a diversified supplier base—including local mills and alternative alloy sources—will reduce single‐point vulnerabilities.

- Advocate Industry Coalitions: Collective dialogue with trade authorities, both in China and abroad, can help shape more stable, long-term tariff frameworks.

In this volatile environment, resilience for Chinese metal fabricators will derive from agility—in automation, supply-chain design, and strategic partnerships—rather than reliance on temporary tariff reprieves.

Read and Share on LinkedIn

Get Latest Updates from Us

Talk to our experts. Our qualified engineers are always happy to answer your questions.